Fx "PULL BACK" Strategy:

The system is all about pullback trading. I find these types of trades to be very profitable, less risky and easier to understand than trend-reversal trades.

I use this system with two pairs GU and EU, and I want to assure you this is more than enough. Otherwise it gets hard when you try to watch more than two pairs. I even find it difficult to watch 2 pairs, because sometimes it leads to missing entries on one of them.

Just remember this; if you master the system you should get no less than 300-400 pips a week from these pairs, guaranteed.

When to trade:

I trade this system during active market hours. I advice to look for entries starting 5 GMT and until 8 GMT (this is when Tokyo session end overlaps with Frankfurt and London openings). And also starting 11 GMT until 15 GMT. (This is after Middle East is done trading, London and Frankfurt are back from their lunch and NY traders kick in later on)

System description:Basically, all you need for a pullback trading is an established trend. It’s up to you what indicator and TF you will use to find a trend – the greatest thing about forex is that everything works here until you strictly follow the rules. So you just have to pick what suits you the most.

I use 5M TF and a longer term MACD (38, 120, 20) for identifying the trend. (Got it from the great scalping strategy described here:

http://www.forexfactory.com/showthread.php?t=90639 )

MACD >0 – trend is up

MACD <0 – trend is downI also have 50 and 200 EMA on my charts. They act as dynamic S/R lvls and also help me to determine the trend by looking at their positioning in the relation to each other.

The rules are following:

50 EMA > 200EMA – trend is up

50 EMA < 200 EMA – trend is downIt is good to look at the slope of these averages as well. Its better when both of the averages are sloping in one direction and not going sideways (consolidation).

Pullbacks: I use stochastic (14, 3, 3) for identifying pullbacks.

I consider a pullback to be valid if stoch dips below/goes above the 50 lvl.

I also have 15M stoch on my 5M chart which sometimes helps me to filter out fake pullbacks. I want 5M and 15M stochs to align in one direction when I’m entering the trade.

Entry rules: Now these are somewhat subjective, but basically I would advice to do the following. (Described for longs, do opposite for shorts)

Entry:MACD (38, 120, 20) > 0

50 EMA > 200 EMA and both sloping up

Stoch (14, 3, 3) makes a pullback and goes below 50.

Enter when 5M bar is above 50 EMA and stoch is breaking the 50 lvl upwards. It is important for stoch to build up upwards momentum that is why we want it to be above 50 lvl when we enter the trade.

Stop Loss:Place SL below the swing low or @ 20-30 pips from your entry point. It shouldn’t be more then that.

Targets:Well, this is the trickiest part. Here are the few possibilities to consider.

1. Exit at the predetermined amount of pips.

2. Exit at the standard fib extension measured from the pullback.

3. Exit when Stoch (14, 3, 3) goes below overbought lvl of 76.4

4. Exit at the nearest S/R lvl.

Exits are currently the biggest pain in the neck for me, because I never know for sure when to get out. So quite often I end up getting 30 pips where I could’ve gotten 100 or even more. I’m hoping this thread through collaboration of traders will come up with some strict exit rules which will help everyone maximize their profits.

Below are pictures with examples of today’s possibilities.

I took a GU trade and sadly missed the EU. Got out using fib extension on GU @ 44 pips. Entered using market order.

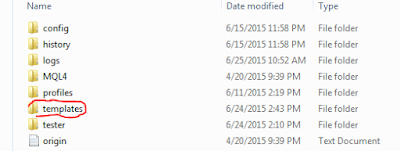

TEMPLATE AND INDICATORS GIVEN BELOW THE IMAGE TO SET THE TEMPLATE: Here are the indicators and a current template I'm using. Hope it helps! The only two non-standard indis are KG S/R lvls a (dotted lines on the chart which help me to identify important swing high/lows) and MTF stochastic indicator which allows having 15M stoch on 5M chart.

DOWNLOAD HERE  #KG Support and Resistance Alert_Revision 2.ex4

#KG Support and Resistance Alert_Revision 2.ex4 +Stochastics (MTF_for M5).ex4

+Stochastics (MTF_for M5).ex4 plb_5M.tpl

plb_5M.tpl